Explore Ola Electric’s EBITDA performance and understand whether the company is on the path to profitability. Dive into their financial metrics and future outlook.

Understanding Ola Electric’s EBITDA and Financial Performance

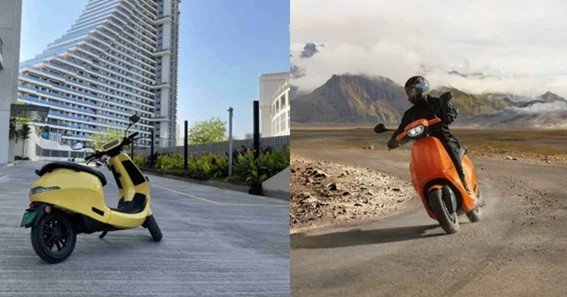

Ola Electric, a key player in the EV industry, has shown significant growth, but its journey to profitability is still under scrutiny. The company’s EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is a crucial metric to evaluate its operational efficiency and profitability potential.

As of the latest reports, Ola Electric posted an EBITDA loss of ₹131 crore for Q1 FY25, which, while still negative, shows improvement from the previous year’s ₹182 crore loss. This reduction in losses indicates that the company is making strides towards operational efficiency, although it remains unprofitable.

The Road to Profitability

Ola Electric’s efforts to streamline operations, reduce costs, and increase revenue are evident. The company has been focusing on expanding its market share in the electric two-wheeler segment, where it holds a significant position. However, the path to profitability will require sustained efforts to enhance EBITDA margins and manage operational costs effectively.

FAQ

- What is Ola Electric’s current EBITDA?

Ola Electric’s EBITDA for Q1 FY25 is a loss of ₹131 crore. - How does EBITDA impact Ola Electric’s financial health?

EBITDA reflects the company’s operational efficiency, showing how well it manages its core business without considering financial and accounting decisions. - Is Ola Electric on the path to profitability?

While still posting EBITDA losses, the reduction in these losses indicates progress toward operational efficiency and eventual profitability. - What factors influence Ola Electric’s EBITDA?

Key factors include operational costs, revenue from vehicle sales, and market expansion efforts. - Why is EBITDA important for investors?

EBITDA provides insight into a company’s operational performance and profitability potential, making it a crucial metric for investors.

Ola Electric’s journey towards profitability is ongoing, with improvements in EBITDA signaling positive momentum. However, continued focus on cost management and revenue growth will be key to turning this momentum into sustainable profit

Disclaimer: This article is for informational purposes only and should not be taken as financial advice. Always consult a financial advisor for investment decisions.